|

What Tax Forms Should I File ?

|

|

Should I still file by the April 15th deadline if I don't have the money to pay

my taxes ?

|

|

What happens if my tax return is filed late ?

|

|

Is it better to file my return early or should I wait until the April 15th

deadline ?

|

|

Does a tax return have to be filed in behalf of someone who died this

year ?

|

|

Can a surviving spouse still file a joint return for the year the death occurred in ?

|

|

Do college students need to file income tax returns ?

|

|

Should I E-File or Paper File?

|

|

How to prepare my tax return for mailing?

|

|

Payment Methods Accepted by the IRS

|

What Tax Forms Should I File ?

1.

1040EZ, or 1040A, or 1040 ?

Form 1040EZ is the simplest of

the forms to use. You can use this Form if you meet all

of the following requirements:

-

Your filing status is single or married filing jointly

-

You (and your spouse if married filing a joint return) are not 65 or older or blind

-

You do not claim any dependents

-

Your taxable income is less than $100,000. Your income is only from wages,

salaries, tips, unemployment compensation, taxable scholarship

and fellowship grants, and taxable interest of $1,500 or less

-

You did not receive any advance earned-income credit payments

-

You do not claim a student loan interest deduction or an education credit

-

If you were a nonresident alien at any time in the year, your filing status is

married filing jointly

-

If you do not itemize deductions, claim any adjustments to income or tax credits

other than the earned-income credit, or owe any taxes other than the amount from

the tax table.

1040A lies somewhere in between

1040EZ and 1040. To use it, your total taxable income must be

less than $100,000, but your taxable interest and dividends can

be more than $1,500. This form does not allow you to itemize,

but it does permit you to deduct an IRA contribution and claim

the child-care credit.

Form 1040 is the longest, most

used and least simple of all. This is the form that allows for

itemized deductions to be claimed. You'll be required to fill

out the 1040 if your taxable income is $100,000 or more, or you

receive certain types of income such as rent or capital gains.

In order to itemize on the 1040, you must fill out an

additional form called Schedule A, which will help you figure

out the value of your itemized deductions.

2.

When should I file Schedule A ?

If your deductible personal and family

expenses, as defined by the IRS, add up to more than the

standard deduction for your filing status, and you have the

records to prove them, you should itemize your deductions

instead of claming the standard deduction. To do that, you'll

have to file Form 1040, and complete Schedule

A and attach it to your tax return.

Schedule A divides your itemized deductions into six major categories:

- medical and dental expenses

- state and local taxes

- interest

- gifts to charity

- casualty and theft losses

- miscellaneous deductions

2.

What tax schedule do I use to report interest and dividend income ?

If you received more

than $1,500 in dividend or interest income for the year, your

tax return will have to be accompanied by Schedule

B, Interest

and Dividend Income. Schedule B is broken down into three parts.

Part I is where you list all your interest income. Part II is where you

list all the information about your dividend income. Part III asks about

any foreign accounts or foreign trusts that you might be involved with.

3.

What tax schedule do self-employed individual fill out?

If you are the sole

owner of a business or operate as an independent contractor,

you will need to file a Schedule C to report income or loss

from your business activities. If you have $400 or more of

business income over and above your expenses, you need to file

a Schedule C or C-EZ,

and a Schedule SE to pay self-employment

tax, even if you would not otherwise have enough income to be

required to file a tax return.

4.

What tax form do I use to claim unreimbursed employee business expenses ?

The IRS will let you

deduct employee business expenses that your employer will not

reimburse you for. The form you need to fill out to claim

these write-offs is IRS Form 2106, Unreimbursed Employee

Business Expenses. Among the most common deductions claimed on this

form are the use of your car to perform your job, work-related travel

expenses and business meals. You can choose to file a regular Form 2106,

or you may qualify for the shorter and simpler Form 2106-EZ.

5.

What tax schedule do I use to report capital gains and losses ?

If you sold or exchanged any securities or certain other property during the

tax year, you will probably have to complete Schedule D,

Capital Gains and Losses. Schedule D can be highly annoying, especially if you are

an active investor who buys and sells often. Beginning in 1998, if you sell your

principal home and can exclude all of the gain (up to $500,000 for married couples

filing a joint return and $250,000 for single filers), you do not need

to report the sale on your tax return. If you cannot exclude all of the gain,

you must report the sale on Schedule D.

6.

What tax schedule do I use to report supplemental income and loss ?

Schedule E, Supplemental Income and Loss, is one of the IRS'

most difficult forms. Unfortunately, you will probably have

to fill it out and attach it to your federal tax return if you

were involved with rental real estate, invested in a partnership,

had certain other investments or income, or were involved in

a trust or "S corporation."

7.

What tax form do I use to pay estimated tax ?

IRS Form

1040-ES

, Estimated Tax for Individuals, is the form you

must use to pay your estimated tax. You pay estimated taxes

when you have income that is not subject to withholding.

|

Should I still file by the April 15th deadline if I don't have the money to pay my taxes ?

It is definitely in your best interest to at least file by the

deadline, even if you can't pay for your taxes then. The penalty for failing to

file a tax return by the deadline is %5 per month of the owed taxes. However, as

long as you file by the deadline, even without payment, the penalty is only 5%

per month of the owed taxes. Partial payment will lessen the penalty, so if

possible, include a check with your return, even if it is not for the total

amount due.

|

|

What happens if my tax return is filed late ?

If filed late

without reasonable cause, a penalty for each month the return

is late may be imposed. The IRS will also charge interest on

the tax you owe

|

Is it better to file my return early or should I wait until the April 15th deadline ?

Whether to file your return early or not really depends on whether you

expect to receive a refund or expect to owe money to the IRS. Generally

speaking, people who are going to receive a refund usually do, and should,

file early while people who owe the IRS should wait until closer to the deadline to pay.

Why part with your money unnecessarily early?

|

|

Does a tax return have to be filed in behalf of someone who died this year ?

As morbid as it may sound, an income tax return still has to be filed for

someone who died during the year. The burden of filing the tax returns falls

upon a survivor or the executor of the estate. Regardless of when the death occurs,

the taxable year for the deceased is still the normal tax year.

Medical deductions can be taken on expenses incurred within one year

of the death on either the dead person's final return or on the

estate taxes' return--not both.

|

|

Can a surviving spouse still file a joint return for the year the death occurred in ?

Yes, you may file a joint return if you are newly widowed. You may even be able

to file jointly up to 2 years after the death of a spouse if you meet certain requirements.

As long as you were entitled to file a joint return the year your spouse died,

your children qualify as dependents and your home is their primary residence,

you have not remarried and you support your household by providing over half

the cost of maintenance, you may file a joint return for two years following

the death of a spouse.

|

|

Do college students need to file income tax returns?

Whether or not an individual student has to file an income tax return depends

on whether the student is claimed as a dependent on parent's tax returns and

whether the student earns income. You do not have to file if you are a student

and your parents claim you on their tax returns and you made less than $12,000

in earned income or your unearned income combined with your earned income was

less than $1,000.

|

|

Should I E-File or Paper File?

Submitting your tax return by e-file and mailing it on paper are the only two ways to send your tax return to the IRS.

E-file is faster, safer, and generally more convenient than paper filing. Filing on paper is generally cheaper, and refunds take longer.

E-file benefits

Electronically submitting your tax return to the IRS is faster, more convenient, and more secure than paper filing.

But in order to e-file your return you have to have your taxes done by a tax preparer, prepare them yourself

using tax software, or use one of the "Free File" web software programs.

Confirmation from the IRS

The biggest benefit for electronic filing: you will receive a confirmation that the IRS has received your tax return.

This is proof that the IRS received your tax return and has started processing it. If the IRS does not accept your tax return,

you will get a rejection notice. The confirmation or rejection notice is sent within 24 hours of transmitting your return.

The IRS e-file rejection letter will tell you how to fix your tax return so it will be acceptable to the IRS.

Faster and More Accurate

E-filing has some added benefits too.

Your refund is likely to be processed faster. E-filing means the IRS does not have to re-type your tax return at their service center,

which means less chance that the IRS will make a mistake when processing your return.

E-file limitations

Electronically is not for everyone, though. You must file on paper if you are:

- Married, but filing a separate return, and you live in a community property state

- Claiming a dependent who has already been claimed by someone else

- Submitting a tax form that cannot be electronically filed (such as a multiple support agreement)

- Filing before e-file begins (January 15) or after e-file ends (October 15)

|

|

How to prepare my tax return for mailing ?

Filing on paper is the best option for you if you have a fairly simple tax return,

or if you are not eligible for e-filing. Because the IRS re-types every paper return it receives,

you should seriously consider e-filing if you have a more complex tax return.

Your tax return is complete and ready to be mailed. Now what?

The IRS recommends that you take a few minutes to make certain

that all information is complete and accurate before sealing that envelope.

This simple precaution could help you avoid mistakes that may delay

your refund or result in correspondence with the IRS.

Here are just a few items to complete prior to mailing your tax return:

- Sign your return. Your federal tax return is not considered a valid return unless it is signed.

If you are filing a joint return, your spouse must also sign.

- Provide a daytime phone number. This may help speed the processing

of your return if the IRS has questions about items on your return.

If you are filing a joint return, you may provide daytime phone numbers

for either you or your spouse.

- Assemble any schedules and forms behind your Form 1040 or 1040A

in the order of the "Attachment Sequence No." shown in the

upper right hand corner of the schedule or form.

Arrange any supporting statements in the same order

as the schedules or forms they support and attach them last.

- Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040.

Also attach Forms 1099-R if tax was withheld.

- Use the coded envelope included with your tax package to mail your return.

If you did not receive an envelope, check the section called "Where Do You File?"

in your tax instruction booklet or click

here

to find the Internal Revenue Service Center address for your tax area.

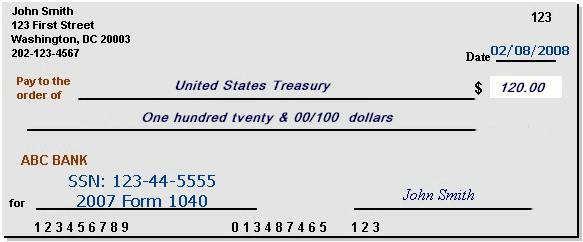

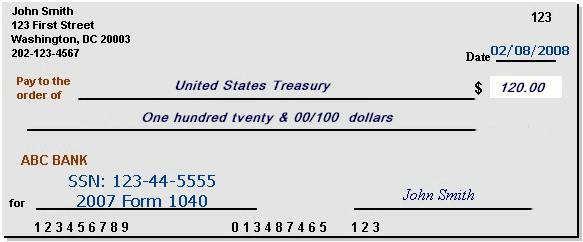

- If you owe tax, make your

check

or money order payable to the "United States Treasury." Write

your name, address, Social Security number, daytime

telephone number, tax return year, and appropriate form

number(i.e."2002 Form 1040") on your payment. Then complete

Form 1040-V following the instructions on that form and

enclose it in the envelope with your payment. Do not staple

the payment to your return.

|

|

Payment Methods Accepted by the IRS

- Personal Check or Money Order

This is the traditional method of paying when mailing a paper return.

Be sure to write your Social Security number in the memo field.

Check sample:

Direct Debit

If you are filing a return electronically, direct debit may be the solution.

The IRS will debit a checking or savings account.

The plus side to direct debit is that you can specify the date of this

debit which means you can file early and still not pay until April 15th.

Click

here

for details

Credit Card

American Express, MasterCard or

Discover can be used to charge taxes due by calling either

Official Payments Corp. at 1-800-2PAY-TAX. You can also pay by credit card over

the Internet at

www.officialpayments.com. A convenience fee is applied at the time of payment.

Installment agreement

If you're financially unable to pay your tax debt immediately, you can make monthly payments

through an installment agreement. As long as you pay your tax debt in full, you can reduce

or eliminate your payment of penalties or interest, and avoid the fee associated with setting up the agreement.

Read more

here

|